Our market

As Europe races toward decarbonization, the demand for clean energy solutions is skyrocketing. While green hydrogen is often seen as a future solution, the reality is that hydrogen is already a crucial part of today’s economy, with over 9 million tons consumed annually in the EU.

The challenge? Most of it is still derived from fossil fuels.

The race for clean energy

Hydrogen – a market that already exists

The market for hydrogen did not begin with the introduction of green hydrogen based on renewable energy. Today, the European Union already consumes vast amounts of hydrogen across a wide range of industries—from the production of alcohol and glass to refineries.

Green hydrogen will not only replace hydrogen primarily derived from natural gas but also expand the market by substituting other energy carriers—particularly within the mobility sector—on the path to a zero-emission society.

Beyond replacing part of the current hydrogen consumption, green hydrogen will also create new markets.

Green hydrogen will not only replace hydrogen primarily derived from natural gas but also expand the market

Regulatory pressure and mandatory climate goals

EU Climate Law:

Legally binding targets for 55% GHG reduction by 2030 and climate neutrality by 2050.

RED III:

Mandatory 42.5% renewable energy consumption in the EU/EEA by 2030, specific targets for green hydrogen in transport and for industry.

Estimate:

Based on these commitments, Hydrogen Europe has estimated a demand of 7.1 million tons of green hydrogen per year by 2030.

Over the past decade, there has been no shortage of ambitious climate targets, but many have already failed to meet their promises. However, the European Union has gone beyond merely setting ambitions—some targets have been implemented as legally binding commitments, with severe consequences for member states that fail to comply.

A key player

in the transition

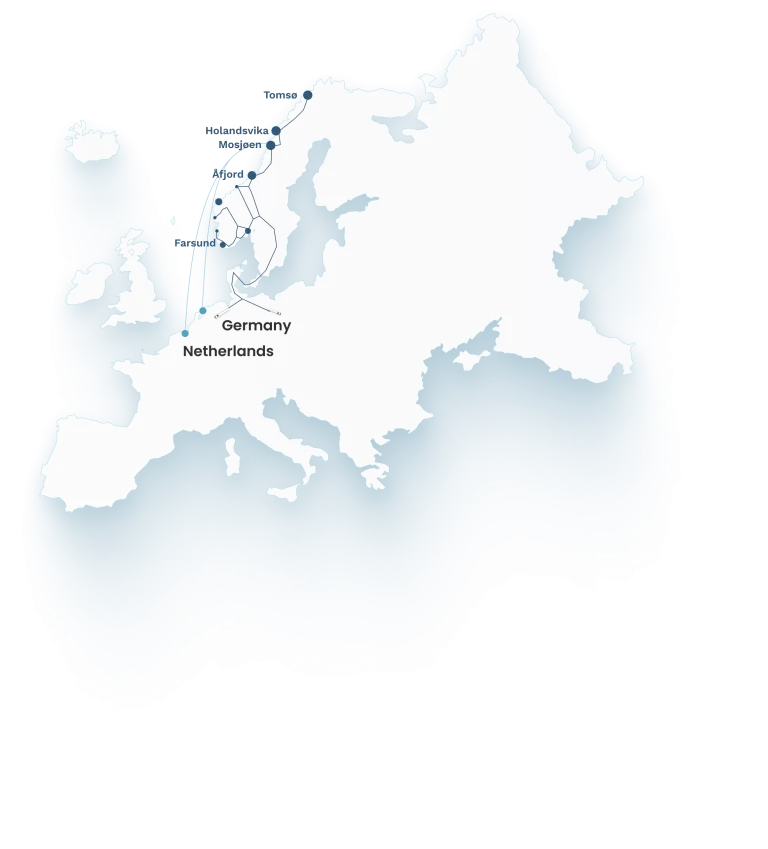

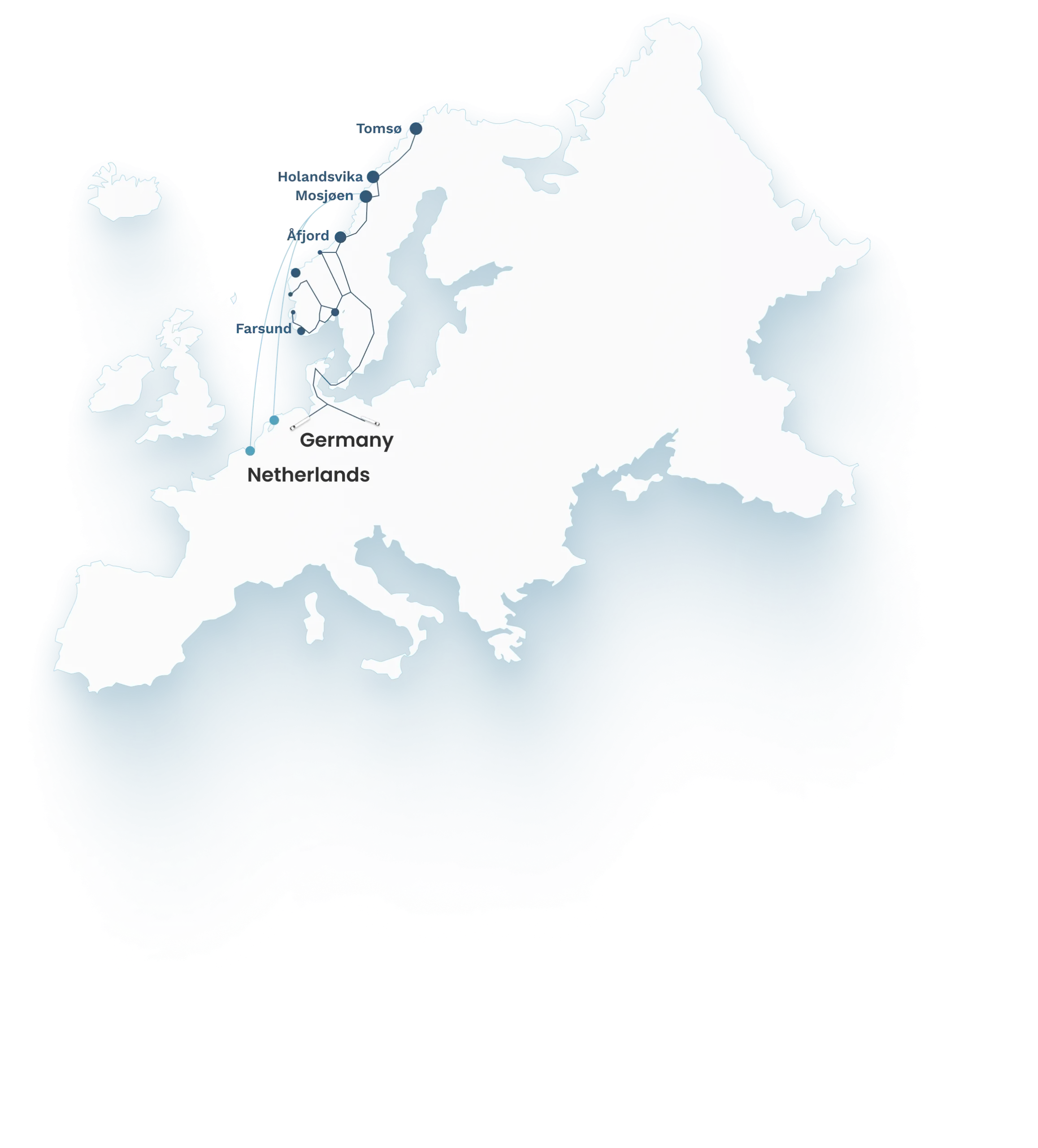

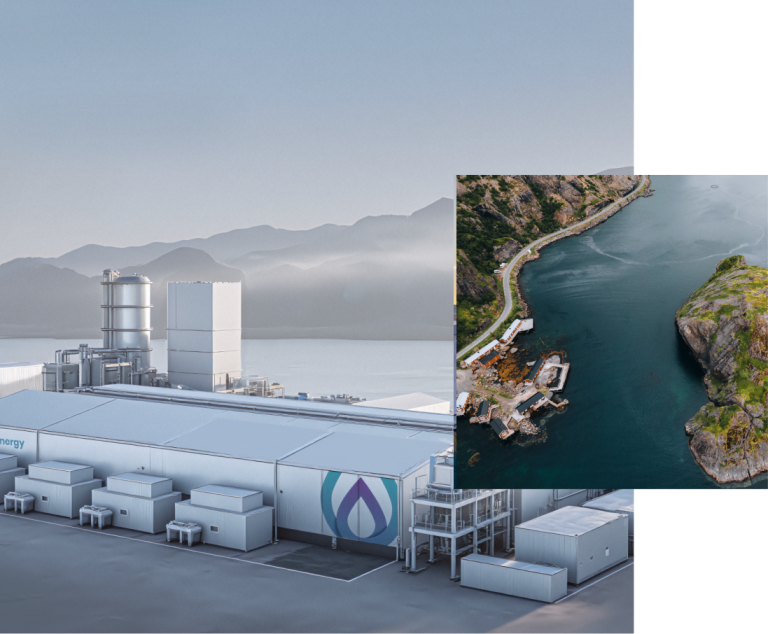

Gen2 Energy is positioned to be a key player in this transition. Our competitive advantage comes from access to low-cost renewable energy, innovative production methods, and strategic partnerships that enable efficient transportation of liquid hydrogen to key European ports.

With cost-efficient shipping solutions for liquid hydrogen emerging, we will be able to deliver at an unbeatable price to key locations such as Rotterdam, Amsterdam, and Hamburg.

Unlike other hydrogen suppliers reliant on unpredictable gas imports, Gen2 Energy’s fully renewable production process ensures long-term price stability and energy security for our customers. This makes us an attractive partner for industries looking to decarbonize while maintaining a reliable energy supply.

Gen2 Energy isn’t just part of

the hydrogen economy—we’re shaping it.

Strategic growth

and market leadership

With the most competitive value chain in a fast-growing market, Gen2 Energy is well-positioned to secure end customers at a price that ensures an outstanding return on investment for our investors.

Based on already signed agreements, it is highly likely that Gen2 Energy will become a key supplier to the shipping industry in Norway and potentially Northern Europe. We are also poised to play a critical role in supplying the mobility industry in Northern Europe as it seeks to meet EU-mandated minimum green hydrogen requirements.

Green hydrogen: powering mobility and industry

Green hydrogen will be a key driver in multiple industries, particularly in mobility and industrial applications. In the mobility sector, green hydrogen can be used in RFNBO for transport, hydrogen road transport (FCEV), maritime applications, and aviation. These sectors are actively seeking sustainable alternatives to fossil fuels, and green hydrogen provides a viable pathway to reducing emissions.

On the industrial side, green hydrogen is essential for refining (non-transport fuel production), ammonia production, methanol production, light industry, and steel manufacturing. These industries require hydrogen for their processes and are transitioning from fossil-based hydrogen to renewable hydrogen to meet climate targets.

Mobility

Industry

The time to invest is now

Gen2 Energy isn’t just part of the hydrogen economy—we’re shaping it. With a scalable business model, strategic positioning, and the most competitive value chain, we are ready to power Europe’s clean energy transition and drive the next wave of industrial decarbonization.

With legally binding EU hydrogen targets driving demand and Gen2 Energy poised to be a market leader, now is the time to invest in the future of clean energy. Contact us to learn more about our growth strategy and investment opportunities.